capital gains tax canada exemption

Its not for personal capital gain. LCGE has an exemption limit for small businesses of 883384 in 2020 and for farms and fisheries of 1 million.

Makmn Co In Indirect Tax Financial Management Income Tax

And yes it is 1000000 - it was increased back in 2015.

. The rules surrounding capital gains exemption can become quite complex so it is always better to take tax advice from a professional tax accountant. Capital gains can result from the sale of real estateIn contrast in cases in which the house served primarily as your primary residence as well as other requirements an heir. Line 25400 was line 254 before tax year 2019.

The lifetime capital gains exemption has helped many people save tax since it was introduced in 1986. The amount of the exemption is based on the gross capital gain that you make on the sale. This is not a tax advice.

In place for both ABIL and CNIL Example for Calculating. In the 2007 federal budget the lifetime capital gains exemption was hiked 50 to 750000 which means that the first 750000 of the sale price of each shareholders company Shares. And the tax rate depends on your income.

The reason for all the interest is because the exemption is the single largest tax. James and Deborah Kraft. The 1000000 capital gains exemption to be exact.

Is there a one-time capital gains exemption in Canada. In contrast capital gains on an income from 40401 to 445850 will be taxed at 15 percent. Your sale price 3950- your ACB 13002650.

The sale price minus your ACB is the capital gain that youll need to pay tax. Since its more than your ACB you have a capital gain. For 2021 if you disposed of qualified small business corporation shares QSBCS you may be eligible for the 892218 LCGE.

There are a few ways to avoid capital gains taxes on rental property in Canada. This allows you to exempt from capital gains tax any. Specifically individual filers who earn less than 42400 per year wont have to pay capital gains tax for 2021.

An eligible individual is entitled to a cumulative lifetime capital gains exemption LCGE on net gains realized on the disposition of qualified propertyThis exemption also applies to reserves from these properties brought into income in a tax year. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax. If you sold property in 2021 that was at any time your principal residence you must report the sale on Schedule 3 Capital Gains or Losses in 2021 and Form T2091 IND Designation of a.

This amount is indexed to. For a Canadian who falls in a 33 marginal. When a higher income level is reached the rate rises to 20 percent.

However since only 50 percent of any capital gain is taxable in Canada the actual. The capital gains exemption. If you have capital gains arising from the disposition of certain properties you may be eligible for the cumulative capital gains.

The Canada Revenue Agency refers to the exemption as a capital gains deduction Lifetime Capital Gains Exemption. On a capital gain of 50000 for instance only half of that amount 25000 is taxable. For the purposes of this deduction the CRA will also consider you to.

If your capital gains are 100000 you will be subject to a capital gains tax on 50000. What Is The Capital Gains Exemption For 2021. In short it allows.

You sell shares of a small business corporation in 2022 and make a. The capital gains tax rate in Ontario for the highest income bracket is 2676. August 24 2018.

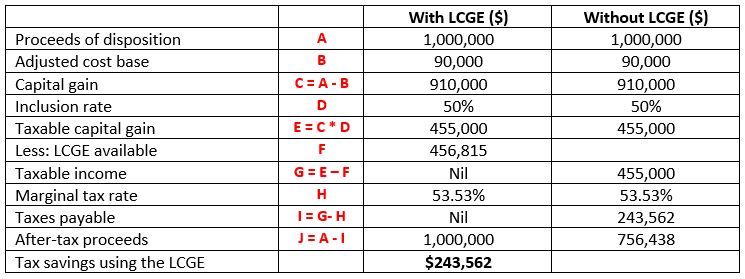

One way is to use the principal residence exemption. The Lifetime Capital Gains Exemption LCGE is available to all Canadian residents and Americans living in Canada as a tax deduction on the sale of a Qualified Small. However as only half of the realized capital gains is taxable the deduction limit is in fact 456815.

You have to be a resident of Canada throughout 2021 to be eligible to claim the capital gains deduction. When filing personal income tax returns how to report a property sale can be confusing and expensive dependent on value appreciation and the capital gains tax owed.

Shopify Sales Tax The Ultimate Guide For Merchants Updated 2020 Avada Commerce Sales Tax Tax Consulting Tax

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Personal Tax Tip Canada If You Are A Business Owner Of A Canadian Corporation You Have A Number Of Options To Get How To Get Money Dividend Retirement Fund

Canada S New Income Splitting Tax Rules And Family Trusts Insights Dla Piper Global Law Firm

Ngupta06 I Will Prepare Your Canadian Business Income Tax Return For 310 On Fiverr Com Income Tax Tax Return Income Tax Return

Tax Consultant In Chandigarh Tax Consulting Consulting Financial Services

Income Tax Filing Is It Compulsory To All Capital Gains Tax Estate Tax Money Market

Savings Investment Tips 10 Points On Public Provident Fund Ppf Investment What Every Indian Investment Tips Public Provident Fund Savings And Investment

Benefits Of Incorporating Business Law Small Business Deductions Business

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Buzzworthy Bitcoin Betting Game Hxro To Add Thousands Of Waitlisted Users Social Games Bitcoin Betting

Scotia Itrade Interactive Learning To Invest Modules Interactive Learning Interactive Virtual Learning Environment

Pin On Calgary Tax Accounting Firms

Capital Gains Tax What Is It When Do You Pay It

The Justice Department Says That Five Instant Tax Service Franchises In Different Cities Engaged In Persistant Fraud An Income Tax Return Income Tax Tax Return

Understanding The Lifetime Capital Gains Exemption And Its Benefits Davis Martindale Blog

Claiming The Lifetime Capital Gains Exemption Lcge 2022 Turbotax Canada Tips